Those are the main things, of late. but let’s see: what else can I tell you? Well, after many years back in the workforce, and freelancing when I can — gradual school: kids, don’t do it — I’ve been able to extricate myself at last from the usual post-grad pit of penury and get back in black. Of course, retirement is only 25-30 years away now, so…

Sounds like a plan. But, so far, buying SunEdison (nee SUNE, now SUNEQ) was an out-and-out disaster — thankfully, I got out a few months before the final collapse. That hasn’t helped the solar ETF (TAN) either. And of the twenty or so stocks I’m currently holding, a good handful of them are just dogs: I’m looking at you, Twitter (TWTR), Fireeye (FEYE), and Teladoc (TDOC). (On the flip-side, my best picks so far are ATVI (Activision), Adidas (ADDYY), and Intuitive Surgical (ISRG).)

Anyway, I’m probably boring you with all this. (I also presume getting more into the markets is a general aging thing — just wait until this turns into a golf, tennis, and back-pain blog.) But, I thought I’d mention it, since, while this isn’t going to be Seeking Alpha anytime soon, I may be inclined to post more Wall street-type stuff here in the future.

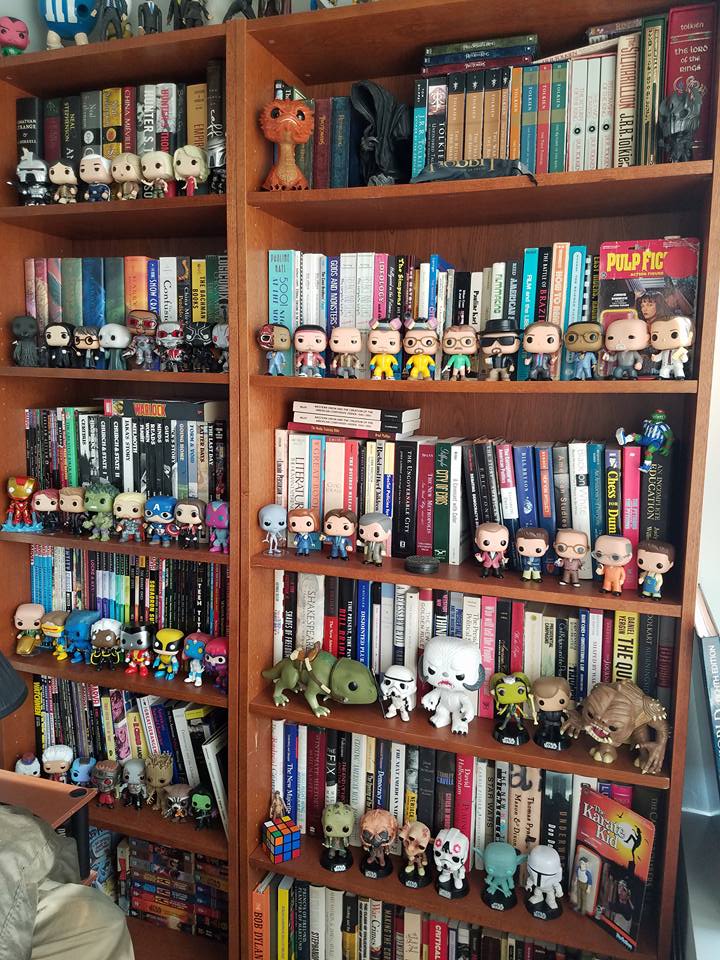

But, just in case you’re thinking GitM has put away childish things…

One additional boon of Funko-buying, besides it scratching that old Star Wars figure itch: It really adds structure to your mall-crawls. For decades, I’ve been like, eh, these stores are all boring. Now, I’m all “hey, this mall has a Hot Topic, a Gamestop, and an FYE. To arms!

Next big trip: our honeymoon, which will include a week+ in Vietnam (probably doing Ho Chi Minh City and Da Nang/Hue/Hoi An, while leaving Hanoi and Halong Bay for a future trip) and a week+ in Japan (Tokyo, Mt. Fuji, Osaka/Kyoto, and possibly Hiroshima). If you have any travel suggestions, feel free to drop them in the comments.

I saw Weiner, The Lobster, and The Witch over the long weekend, all worth seeing for different reasons. I’ve been picking up new shows in Mr. Robot and Preacher, while keeping up with Game of Thrones, Better Call Saul, The Flash, and the like.

Since Arkham Knight and Fallout 4 are done, and my rogue is all kitted out and waiting for Legion, most of my gaming time these days involves Hearthstone (great for the walk home) and the recently-released Overwatch, a.k.a. Blizzard’s stab at Team Fortress 2. (I mostly play Reaper, even if my name — Jacklowry — isn’t all that Reaper-ish.)

Nope, life is good. Very good. The only real issues these days are the general dismal state of politics, rampant inequality and poverty, encroaching climate change, etc., but those are issues for the rest of the blog.

Serious question: why mess with individual stocks at all? The weighted target funds will handle the diversification – I look at it this way: why should I, a casual investor, have any chance of doing better than the market (which the funds will reflect)? So my view is that individual securities are gambling money and I don’t have any gambling money. (I think we hold one individual stock based on spousal affection for a company-you can guess which one-which I indulge, but not too much…. 🙂 )

FWIW: We’ve found the postcard advice (http://lifehacker.com/all-the-financial-advice-youll-ever-need-on-a-4×6-inde-1334131550) to be a pretty useful model. Put as much as possible into broad-based indexes with low, low fees and hold.

(Also, keep an ear out for what Barry Ritholtz has to say.)

Yeah, I hear you — Exhibit B is Warren Buffett’s hedge fund bet. But you answered the question with your one stock. 🙂 It’s more fun/psychologically satisfying to support individual companies whose products/services you prefer. And, while it has more risk/reward, that’s something I can bear, in small doses, with a few decades to go before retirement.