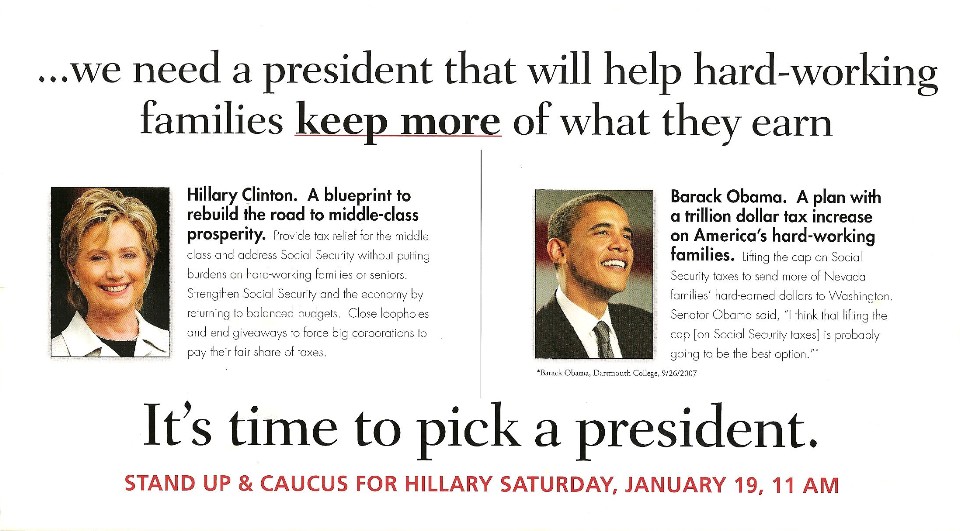

Another state, another patently false mailer. According to TPM‘s Greg Sargent, the Clinton campaign has now blanketed Nevada with the negative mailer above, one which (once again) falsely distorts Senator Obama’s record. It reads: “Nevada families need to keep more of their hard-earned dollars not less…we need a president that will help hard-working families keep more of what they earn.”

It then goes on to read: “Barack Obama. A plan with a trillion-dollar tax increase on America’s hard-working families. Lifting the cap on Social Security taxes to send more of Nevada families’ hard-earned dollars to Washington. Senator Obama said “I think that lifting the cap [on Social Security taxes] is probably going to be the best option.“

So, what’s the problem here? Mainly this: Only somebody who hangs out with the monied likes of Robert Johnson all day could honestly think Senator Obama’s plan involves a tax increase for “hard-working families.” Let’s let Senator Obama explain it:

|

“Now there’s one more way of solving the problem. And that is raising the cap on the payroll tax. Now what that means is, currently, you only pay Social Security on the first $97,000 of income. Now it turns out that here in Nevada, 97% of the people in Nevada make $97,000 a year or less. So essentially, everybody except 3% — if this was a random sample of Nevada, there are only about 3% of you who make more than that, everybody else, you gotta pay payroll tax on 100% of your income. Now, what I’ve said is that what we should do is we should adjust the cap, so that billionaires like Warren Buffett are paying more, because right now they’re paying a fraction of 1% of their income to payroll tax. And my answer is, that’s not fair. Why would we have the wealthiest Americans pay such a smaller percentage of the payroll tax when everyone else is So I propose raising the cap. We might exempt middle class folks for maybe $97,000 for up to $200,000; there might be some exemptions, but those people are making over $200, $250,000, they can afford to pay a little more on payroll tax. So this is what I propose, this is what Senator Clinton is calling a trillion-dollar tax cut on hard-working Americans.” |

So, which is it, then? Does Senator Clinton think the top 3% of Nevadans represents the “hard-working families” of the middle-class, or is this another blatant attempt at misinformation disguised to confuse voters about Obama’s real record? If I had to guess, I’m thinking this is the latter, and it’s another disgusting, GOP-worthy lowball.