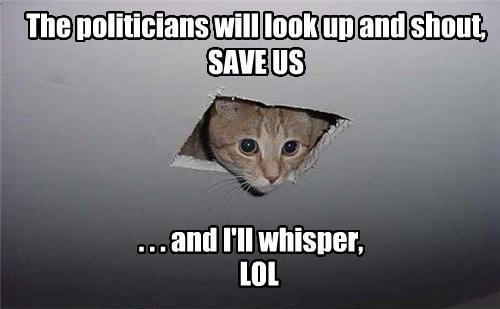

“This move reflects either criminal incompetence or abject corruption by the Fed. Even though I’ve expressed my doubts as to whether Dodd Frank resolutions will work, dumping derivatives into depositaries pretty much guarantees a Dodd Frank resolution will fail.“

Along the same lines, Naked Capitalism‘s Yves Smith responds to the disclosure that repeat offender Bank of America is trying — with the Fed’s help — to foist their more toxic assets into FDIC-backed accounts (meaning that taxpayers will eat the losses.) “[T]his move amounts to a direct transfer from derivatives counterparties of Merrill to the taxpayer, via the FDIC, which would have to make depositors whole after derivatives counterparties grabbed collateral.“

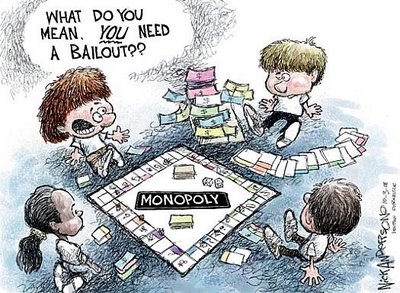

Continues Smith: “The FDIC is understandably ripshit…Bill Black said that the Bloomberg editors toned down his remarks considerably. He said, ‘Any competent regulator would respond: ‘No, Hell NO!’ It’s time that the public also say no, and loudly, to yet another route for running a drip feed from taxpayers to banksters.‘” (Cartoon via here.)