“The president told Democrats that making change happen is hard and ‘if people now want to take their ball and go home, that tells me folks weren’t serious in the first place.’” As part of a continuing pattern of late, President Obama tells Rolling Stone that progressives need to stop whining about the way things are going and get happy, because, in what’s become a new talking point, “If you look at the checklist, we’ve already covered about 70 percent [of the 2008 campaign promises.]” (70%?! Uh, can I see this checklist?)

Anyway, this latest weird effusion against the base has already been well-critiqued and well-answered many times. See, for example, Glenn Greenwald and David Dayen: “I’ve never seen a politician run an election with the message ‘Don’t be stupid, quit your bitching and vote for me.’” I would only add two things:

1) As it turns out, the unhappy Dems among us are more likely to vote, so perhaps berating them for not clapping enough is not altogether productive. (Unless, of course, the WH is doing it as a Sistah Souljah bank shot to get independents, on the classic establishment premise that indies love hippie-punching.)

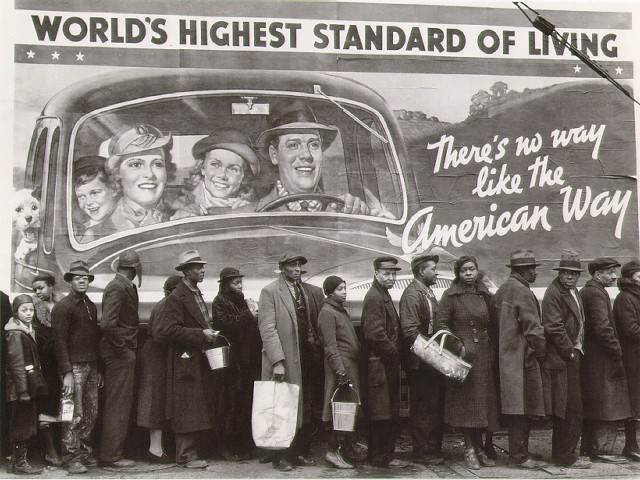

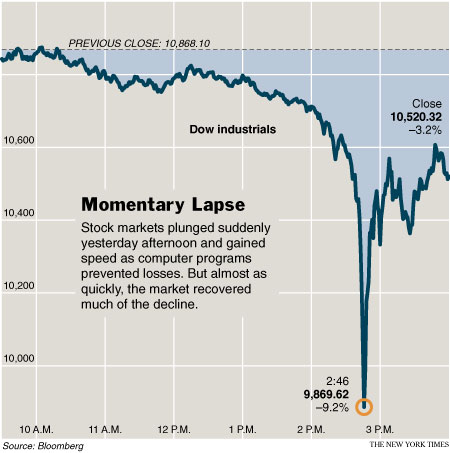

2) I’d love to live in a world where progressive bloggers have the power to move ginormous voting blocs, I really would. But it takes a certain type of top-down, Beltway-obsessive mentality to think that’s what’s going on here. The biggest reason voters are depressed is because the economy is, quite obviously, not doing so well at the moment, and people are feeling the pinch. And, that aside, most Obama voters don’t need blogs to tell them that this administration, on all too many fronts, hasn’t lived up to its promises.

If this White House wants to engage the base (and I really, really hope they do, for reasons personal, professional, and patriotic), then, for Pete’s sake, don’t browbeat and lecture the Left for being disappointed — Try to make them less disappointed! Give them some red meat, respond to their concerns, and, you know, do the things you were elected to do. Why this even has to be said is beyond me.