Imagine for a moment you are president of the United States.

You were just elected in the midst of a worsening economic crisis, one that demands bold action and decisive leadership to confront. Fortunately, you enter office with an historic wind at your back: You enjoy unprecedented enthusiasm and goodwill from millions of new voters, a clear mandate for change, and, most importantly, sizable majorities in both the House and Senate.

You also know that the political opposition — who hold a long and storied record of being ruthless, craven and despicable to get what they want — will try to prevent your agenda by any means necessary.

And, being a student of history, you know that, particularly in the face of a poor economy, this political opposition is very likely to pick up congressional seats in the next election (with a few notable exceptions, one of which I’ll get to in a moment.) In other words, a pendulum swing against you is highly probable, and so the majorities you have are probably as big as they are ever going to get.

Basically, you have two years, and likely two years only, to do pretty much anything you want in order to grapple with this economic crisis. Do you [a] take a page from FDR’s 100 Days, go big, and push hard for the progressive agenda you laid down in your election campaign, which has the added benefit of enthusing the “rising American electorate” that got you elected? Or do you [b] try to ingratiate yourself with people who will always hate you, water down your signature legislative initiatives from the outset, and seemingly go out of your way to depress the lefty base that got you elected?

I think you see where I’m going with this.

First things first, let’s be clear about why the Republicans took back the House so decisively two days ago.

1) It’s the Economy, Stupid. Though it may be mostly Dubya’s fault, the economy is obviously still in terrible shape. The official unemployment rate hovers just under the double-digits, and real unemployment and underemployment levels are much higher. Household incomes are down, consumer debt is up, millions of homeowners are stuck with underwater mortgages, and millions more feel in danger of slipping under. As everyone knows, when economic times are bad, the party in power suffers.

Compounding the situation, families are feeling under the gun at exactly the same time that those same wealthy few who precipitated the Great Recession are now rolling in dough. Having evaded pretty much any and all serious consequences for the meltdown they created, the Big Brains on Wall Street are instead giving themselves record bonuses, and trying to profit from even more rampant corruption on the foreclosure front. To no one does this ugly sight look like change we can believe in.

2) Republicans voted, Democrats didn’t. Again, not rocket science: Democrats lost because Republicans came out and Democrats stayed home. Look at the breakdown of exit polls: As per the norm in midterms, the 2010 electorate was older than the population at large. (23% of the vote versus 13% of the population.) And 57% of those seniors, worried that the threat of Creeping Socialism might somehow interfere with their federal retirement security and universal health care, pulled the lever for Republicans.

Conversely, 29 million Obama voters did not show up to vote. “Hispanics, African Americans, union members and young people were among the many core Democratic groups that turned out in large numbers in the 2008 elections…In 2010, turnout among these groups dropped off substantially, even below their previous midterm levels.” Take voters under 30, for example, who vote Democratic at about the same rate seniors vote Republican. They went from 18% of the electorate in 2008 to 11% this year. Obviously, that’s a problem.

So, working back from these factors — economic performance and voter turnout — it follows that the two best things the administration could have done to improve Democrats’ standing this year would have been to get the economy moving again and to get the Democratic base fired up and ready to go. So what happened? Let’s look at the tape.

The Economy: As Paul Krugman has already pointed out, much of the story of this election was written way back in February 2009, when the Obama administration chose to settle on a stimulus package that was watered-down to appease Republicans who would never, ever vote for it. In fact, thanks to Larry Summers, the stimulus was low-balled from the start — Summers made sure Christina Romer’s higher-end projections for the amount needed never even made it to the president’s desk.

So the crystal was in the steel at the point of fracture, and mainly because Obama, doing the President Goldilocks routine that would become a trademark, watered down the Recovery Act early-on to appease an opposition that was unappeasable.

By late 2009, the warning signs that ARRA was probably too small were all over the place — not the least in the growing state budget crises seen all across the country. But even as Republicans throttled congressional attempts to remedy the situation, the Obama administration remained mostly passive…or, in the case of food stamps, worse. Many in the White House took up the standard of the deficit witchhunt. (Yes, there was some rhetorical urging of the tsk-tsk variety eventually, but that, as on so many other fights, was after the chips were already down.)

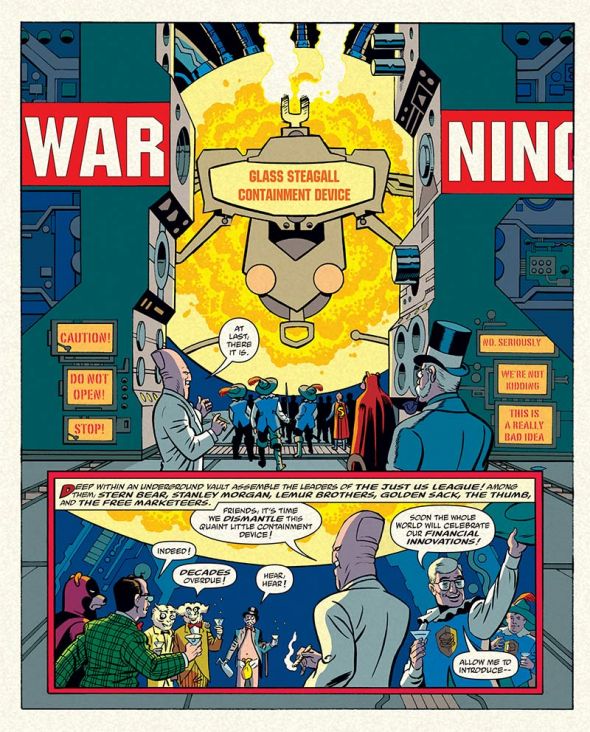

Going along with this frustrating passivity was the increasing sense over time that this administration, elected to be change we could believe in, was more than a little cozy with the Wall Street yokels who caused the economic disaster in the first place. Yes, TARP was originally Dubya’s baby — not that very many voters seemed to remember that fact. (And it’s hard to blame them when folks like Geithner keep touting its merits.) Still, acceding to the $700 billion bailout for Wall Street — with little to no strings attached — was an extraordinarily inopportune way to kick off an administration theoretically premised on fundamental change.

I have to confess that, at the time, I thought TARP was unfortunate but probably necessary. Two years later, I’m thinking I probably just just got railroaded, and didn’t know what I was talking about. (Hey, it wasn’t the only thing I was wrong about in 2008.) But, even back then, I argued that TARP had to come with game-changing restrictions on Wall Street’s behavior. Those, clearly, were not forthcoming.

Yes, Congress did pass financial reform — But let’s remember, Team Obama worked openly to weaken the bill, and even now certain admin folks are clearly trying to derail Elizabeth Warren, the best chance the financial reforms, however tepid, have at working as intended for consumers. (Or, to quickly take another example, there’s the matter of the HAMP foreclosure program, which, as David Dayen has documented, seems more concerned with recouping money for lenders than helping families in trouble.)

As on the finreg bill, so too on other fronts — and this is where we get to the suppressing turnout issue.

On health reform, which thank god eventually passed, we now know that the administration cut deals early on to kill drug reimportation on behalf of the pharmaceutical industry (even after Sen. Dorgan reintroduced the idea) and, more egregiously, to kill the public option on behalf of AHIP and the hospitals. Looking back, the president signaled the public option’s expendability in his September 2009 health care address, another classic example of the wait-too-long-then-try-to-swoop-in-and-save-the-day legislative strategy usually preferred by the White House. And by the eve of the midterms, he was openly mocking public option supporters at fundraisers.

But, even those fundamental breaks with real reform aside, the entire health care process got badly screwed up when the administration, in a misguided attempt to curry bipartisan favor for reform, let Max Baucus dink around for weeks on the Senate Finance Committee. While Republican Senators Snowe and Grassley played Lucy to Baucus’ Charlie Brown and kept moving the football, the Tea Party August of 2009 took shape, and almost a year in legislative time was lost. And, by the time Baucus finally released the durned thing, the bill had once again been watered down to gain imaginary Republican votes that were never, ever going to be forthcoming.

The litany of Obama’s other sins by now are well known. As noted before, this administration has been absolutely egregious on civil liberties, all the while telling us to “look forward, not backward” on Dubya’s torture regime. (But different rules for everyone else, it seems.) Meanwhile, Gitmo is still open, and DADT is still enforced. Immigration reform did not happen. Nor did energy reform, despite House Democrats going out on a limb to pass a bill way back in June of 2009. (Yesterday, Obama the “shellacked” buried this bill for good.) And so on.

If all these compromises and capitulation — which were never political necessities so much as unforced errors — weren’t enough to depress the base, the administration’s press arm continued a steady diet of hippie-punching. “Left of the left“, pajama-wearing bloggers, the “professional left” — time and again, “senior advisors” and press flaks went out of their way to scorn the people who sweat blood and tears to get them elected. I already mentioned Obama ridiculing public option supporters — Well, where did folks ever get the notion that a wonky, badly-named fix like the public option was the ground to fight on anyway? Because the president told us it was important.

To be clear: I am not arguing that Obama hasn’t accomplished anything (although, in almost all cases — including health care reform, much more credit should really go to the very unfairly maligned Speaker Pelosi — she’s the one who made it all happen.) But, at every point down the line, for every piece of legislation that did pass, you have to factor in the opportunity costs that were lost. And consistently, this administration has pursued the politics of the lowest common denominator. To quote the prescient Drew Westen once again:

“I don’t honestly know what this president believes. But I believe if he doesn’t figure it out soon, start enunciating it, and start fighting for it, he’s not only going to give American families hungry for security a series of half-loaves where they could have had full ones, but he’s going to set back the Democratic Party and the progressive movement by decades, because the average American is coming to believe that what they’re seeing right now is ‘liberalism,’ and they don’t like what they see. I don’t, either. What’s they’re seeing is weakness, waffling, and wandering through the wilderness without an ideological compass. That’s a recipe for going nowhere fast — but getting there by November.“

And, hey, look what happened.

Remember how I mentioned a midterm outlier way up at the beginning of this post? That was 1934 — when, in an economy even worse than the one America faces now, Roosevelt managed to pick up seats in both the House and Senate. FDR gave us the 100 Days, a flurry of political activity we haven’t seen before or since. Now, granted, the Roosevelt team did not have to contend with either unfettered money corrupting the system or a pathetic Fourth Estate in a death spiral — both severe problems with our current political culture that must be addressed. Still, when elected in the midst of a similar economic crisis, with similar expectations, this administration did not bring about a 100 Days. It gave us Three Months of Max Baucus dicking around to appease intractable Republicans.

So why did the 2010 shellacking happen? Because of the economy, yes. And because of low turnout, yes. And also because of troubling trends like corrupting money everywhere and a national press in severe decline — The fact that the media followed Christine O’Donnell more than any other 2010 candidate tells you all you need to know about that broken-down disaster we call the Village these days.

But, nonetheless, all of these determining factors were exacerbated in the wrong direction by the administration’s fatal addiction to the Fetal Position fallacy. As I said of this year’s State of the Union address, “people were not looking to President Obama for this sort of deficit tsk-tsking and small-bore, fiddling around the margins. You’d think we Dems would have learned this by now. But curling up into a fetal position and mouthing moderate GOP-lite bromides will not stop the Republicans from kicking us, ever.“

Some argue politics is the art of the possible. That’s true, but I believe much, much more was possible if this administration had actually deigned to fight for it.

Some say the president can only do as much as Congress lets him — he needs 60 votes, yadda yadda yadda. I’d say that he had 60 votes, and even then did not push to make things happen as much as he could. I would also argue that the presidency of the United States is actually a remarkably powerful position these days, that Obama has showed no inclination to act progressive on crucial matters like civil liberties that are totally in his bailiwick, and that, even now with a Republican House, the administration could move forward with a progressive agenda, if it so desired.

Some — such as pathetic, DLC-brand fortunate sons like Evan Bayh and Harold Ford — say progressivism was tried and found wanting. I would argue progressivism was not even tried.

Some say it is time to go for the Dems to embrace a more “centrist”, GOP-lite Third Way from now on. I think we’ve been experimenting with that sad sack of failure for decades now — it’s our First Way — and it’s been proven over and over again not to work. (Just ask the Blue Dogs, who got eviscerated on Tuesday. Why vote for Republican-lite when you can have the real thing?)

Basically, it comes to this. Without vision, the people perish…and vote GOP. And because this administration did not go big, because it did not produce the change people so desperately desired, and because it forsook the possibility of real progressivism early and often to indulge their fantastical belief in the magical unicorns of High Broderism, the Democrats have now lost the House — ironically the one branch of government that, under Speaker Pelosi, actually tried to get done what had been promised.

Now, matters are worse.