Like

W before it,

Oliver Stone’s peppy, decently enjoyable, and ultimately far too convivial Wall Street: Money Never Sleeps, which I caught as the first leg of a three-film swing two weeks ago, suggests the director has moved out of the near-decade-long nadir that brought us

Any Given Sunday and

World Trade Center. (Rock bottom was, without a doubt,

Alexander.)

Wall Street 2 turns out to be a brisk two hours, and its ability to explain some relatively complex financial goings-on in a crowd-pleasing format is admirable. Still, the movie also ends up feeling like a missed opportunity. Bringing 80’s corporate raider Gordon Gekko (Michael Douglas) back to comment on the amoral rapacity of today’s financial sector could be a stroke of genius, and the movie is most entertaining when it shows how the greed and corruption of today’s Wall Street has outpaced anything Gekko could ever have imagined back in the American Psycho era. (“Someone reminded me I once said, ‘Greed is good.’ Now, it seems it’s legal.“)

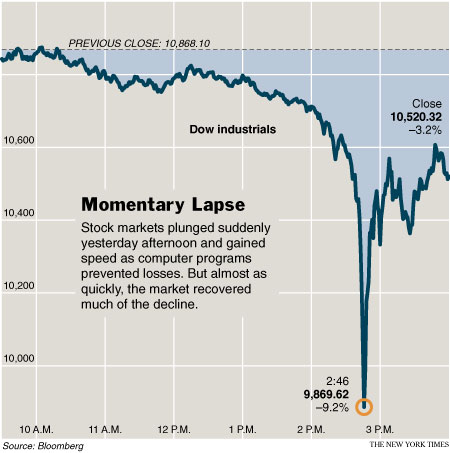

But even more than W, a movie which treated the many foibles of our 43rd president with kid gloves, Wall Street: Money Never Sleeps is a film that seems lacking in sufficient indignation. I mean, those venerable and self-proclaimed Masters of the Universe, the Titans of Wall Street, managed to plunge the entire American economy into a death spiral and pass the bill off to the increasingly jobless American taxpayer. And yet, they still managed to avoid any seriously damaging regulation as a consequence, and, at the end of the day, they give themselves record bonuses for two years running. And all Stone can muster up about it is this? Where’s the outrage?

To be fair, avarice and plunder are central to Stone’s story here, bubbles abound (Stone does love to beat a metaphor to death), and the film does dramatize the September 2008 collapse and subsequent bailout, with Wall Street tycoons Josh Brolin and Eli Wallach, among others, worriedly communing with Hank Paulson and Tim Geithner lookalikes in a darkly-lit Federal Reserve antechamber. The problem isn’t the content so much as the tone. Eventually, you get the sense that, despite all their bad behavior, Stone likes and looks up to these guys. (This may be because Stone’s father was a Wall Street banker, so this may be the film where a director who continually relies on characters with daddy issues is now trying to work out his own.)

As a result, Wall Street feels confused — It doesn’t really seem to know which tale it wants to tell. On one hand, we have the story I just mentioned — the obvious sickness and eventual collapse of the financial sector. But then we also have the story of our protagonist, Jake Moore (Shia LaBoeuf) — a savvier operator than Charlie Sheen ever was — who shuffles through various potential father figures (Gekko, Brolin, and, in the early going, Frank Langella) and woos the professional-blogger daughter of the fallen Gekko king (Carey Mulligan — By the way, Stone doesn’t seem to have a handle on what blogging’s about. We wear pajamas all day, and we don’t have sleek Facebook-looking offices.)

And then we have the Return of Gordon Gekko himself. Now on the CNBC book and lecture circuit, a seemingly chastened Gekko wants Jake’s help to reconnect with his prodigal daughter. In the meantime, he teaches Jake a thing or two about the way the Game is played at the top. And hewatches today’s unsustainable financial shenanigans with wry bemusement — he likes to discourse on tulips — and perhaps a little jealousy. Does Gekko want a seat at the table again? Well, he’s Gordon Gekko. What do you think? (For what it’s worth, Douglas is great fun here — let’s hope it’s not his last performance — but his character is getting a bit of the Ridley Scott’s Hannibal treatment. To my mind, Gekko makes for a better villain than he does an anti-hero.)

In any case, Stone has a lot of balls in the air throughout Money Never Sleeps and as the film goes on they become more and more clumsily handled. This flaw becomes glaringly obvious in the final reel, when the film suffers from more endings than Return of the King, including one — in front of Lady Gekko’s apartment — that comes out of nowhere and feels exceedingly cheap. (The movie even has three closing-credit sequences — one focused on time, one one family, and one on money — Four if you count all the bubbles floating around. Stone apparently couldn’t decide what his film was about.)

There’s a lot of upside to Money Never Sleeps — It’s a surprisingly fun movie at times, and the acting is solid across the board. (People like to hate on Shia LaBoeuf, but I actually think he’s a pretty good actor. Here, he even starts to seem a bit like his father from a more ill-conceived sequel, Harrison Ford — although with less finger and family issues.) Still, I wish the movie weren’t so confused about its purpose, and I definitely wish it took a more aggrieved stance towards its bankster subjects. I don’t want to watch these jokers having totally random Ducati races. I want to see them in jail. (Then again, be careful what you wish for: Gekko says several times here that it’s the next collapse we really need to worry about, and that could happen at any time…like, say, now.)